DEFINITION OF BANK

A bank is a financial institution the primary function of which is to accept deposits from public and lend these funds in the form of advances.

Bank is financial supermarket. It is a one stop solution for all your financial needs.

TYPES OF DEPOSITS

1. DEMAND DEPOSIT

a) Current Account.

b) Savings Account.

2. TERM DEPOSIT

a) Fixed Deposit.

b) Recurring Deposit.

DEMAND DEPOSIT

The account holder can withdraw money any time and on Demand.

- Deposits are Banks Liability.

Savings Bank Account.

- To inculcate the habit of savings among citizens.

- Can be opened by individuals/ jointly/ non-profit organisation.

Features

- Minimum Balance Maintained.

- Penality if minimum balance is not maintained.

- Number of transactions are limited.

- ATM-cum-Debit card facility.

- Internet Banking.

- Mobile Banking.

- SMS alert.

- Utilities Payment.

- Calculated based on daily balance.

- Credited to the account twice a year.

- Concerned bank decides the interest rate.

Current Account

- For Business purpose.

- No interest is paid.

- No restriction to number of transactions.

- Overdraft(OD) facility is provided at the discretion of the Bank.

Over Draft(OD)

- Customer is allowed to draw money over and above the balance in his/her account.

- Bank will charge interest over the amount overdrawn.

TIME/ TERM DEPOSITS

Deposits are repayable with interest only after a certain period of time.

Fixed Deposits

The Money Deposited(Principal) with interest is returned after a definite maturity.

- Interest Rates are high.

- A long term saving instrument.

Recurring Deposits

The Money is deposited in instalments for a defenite period of time. After the maturity period the deposited money with interest is returned back.

- Minimum Instalment amount- Rs 100.

- Term- 1yr to 10 yrs.

TYPES OF LOANS

- Loans are Banks Asset.

1. DEMAND LOANS

a) Gold loan.

b) Crop Loan.

2. TERM LOANS

a) Housing Loans- 15yrs,20yrs,25yrs,30yrs.

b) Personal Loans.

c) Car Loans- 7yrs.

Non Performing Assets (NPA)

An asset becomes Non Performing when there is no interest or repayment of loans for longer than 90 days.

Electronic Clearing System (ECS)

- ECS is a electronic mode of payment/receipt for transactions that are repetitive and periodic in nature.

- Used by institutions for making bulk payment of amounts towards towards distribution of dividend, interest, salary, pension etc.

NEFT (National Electronic Funds Transfer)

- Nationwide payment system facilitating one to one funds transfer.

- Batch Transfer.

- Money can be tranfered from any bank branch having NEFT facility to individuals having an account in any bank branch having NEFT facility.

- Maximum of 2 lakhs.

RTGS (Real Time Gross Settlement)

- Similar to NEFT but used for payments above 2 lakhs.

- Minimum 2 lakhs.

- Happens instantanously and individually.

IFSC (Indian Financial System Code)

Alpha numeric code that uniquely identifies a bank branch participating in a NEFT system.

Standing Instruction

An instruction given by an account holder to his her bank to carry out certain payments from his/her account.

For example, an account holder opening an RD in the bank can give a Standing Instruction to the Bank to deduct the instalment for the RD from his SB sccount every month.

Retail Banking/ Personal Banking

Providing Banking services to individual customers.

Corporate Banking/ Institutional Banking

Providing Banking services to Companies and Big Business.

KYC (Know Your Customer)

- Comes under the Prevention of Money Laundering Act 2002.

- Customers opening a new bank account has to fill a KYC form along with the other forms furnishing his/her pan card number and other details.

Money Laundering

Converting Money obtained through illegal means to legal means is called Money laundering.

CASA(Current Account and Savings Account)

- More CASA more Business.

MSME(Micro Small and Medium Enterprises)

Manufacturing Sector | |

Enterprises

|

Investment in plant & machinery

|

| Micro Enterprises |

Does not exceed 25 lakh rupees-

< 25 LAKHS |

| Small Enterprises |

More than 25 lakh rupees but does not exceed 5 crore rupees-

25 LAKHS TO 5 CRORES

|

Medium Enterprises

|

More than 5 crore rupees but does not exceed 10 crore rupees-

5 CRORES TO 10 CRORES

|

Service Sector | |

Enterprises

|

Investment in equipments

|

| Micro Enterprises |

Does not exceed 10 lakh rupees-

< 10 LAKHS |

Small Enterprises

|

More than 10 lakh rupees but does not exceed 2 crore rupees-

10 LAKHS TO 2 CRORES

|

Medium Enterprises

|

More than 2 crore rupees but does not exceed 5 core rupees-

2 CRORES TO 5 CRORES

|

IMPS (Interbank Mobile Payment Service)

Interbank Mobile Payment Service offers an instant 24x7, interbank electronic fund transfer service through mobile phones in India. Customers can use Mobile Instruments as a channel for accessing their bank accounts and put high interbank fund transfers in secure manner with immediate conformation feature.

This facility is provided by the National Payment Corporation of India (NPCI).

This facility is provided by the National Payment Corporation of India (NPCI).

EMI (Equated Monthly Instalments)

Equated Monthly Instalment is a fixed payment amount made by a borrower to a lender at a specified date each calender month, to pay off both interest and principal over a specified number of years.

Credit Appraisal

It is the process of assesing whether a borrower/ applicant is credit worthy(ability to repay back the money) or not.

Amortization

Gradual elimination of a loan by regular payments.

Mortgage Loan/ Hypothecation

Pledging a House/ Property for availing a loan.

Collateral

Assets pledged by a person to secure a loan.

Insolvent person

A person unable to pay back his debts.

Bankruptcy

Decleration by a court of law that an individual/ company is not capable of paying back its debts.

Negotiable Instrument

- A transferable signed document that promises to pay the bearer a sum of money at a future date or on demand.

- Cheque, Promisory Note, Bill of Exchange.

Cheque

Cheque is a negotiable instrument in writing containing an unconditional order issued to the Bank, signed by the account holder requesting the Bank to pay on demand a certain sum of money.

Drawer- The account holder.

Drawee- The Bank.

Payee- The Person named in the Cheque.

Bearer Cheque/ Uncrossed Cheque

- When the words "or bearer" appearing on the face of the cheque are not cancelled, the cheque is called a bearer cheque.

- The Bearer Cheque is payable to the person specified there in or to anybody else who presents it to the bank for payment.

- Such Cheques are risky.

Crossed Cheque/ Account Payee

- Crossing of Cheque means drawing two parallel lines on the phase of the chque with or without "Account Payee".

- The Crossed Cheque is payable only through the account of the person specified in the Cheque as Payee.

Stale Cheque

- If the cheque is presented for payment after 3 months fron the date of the Cheque it is called Stale Cheque.

- A Stale Cheque is not honored by the Bank.

At Par Cheque

A Cheque payable anywhere in India.

Cheque Bouncing

- Means Dishonoring of Cheques.

- When the Cheque is not cleared for lack of funds or based on the instruction of the account holder it is called Cheque Bouncing.

Mutilated Cheque

Damaged Cheque.

CTS- Cheque Truncation System

- Image clearing system.

- No Physical movement of cheque.

- Faster clearing.

Why does society need Banks ?

- Banking Sector is the corner stone of the Economy.

- Business runs on the needs of Banking.

- Bank is a financial supermarket. Common man requires Banks to fulfill all his financial needs.

How do you classify Banks ?

- Scheduled Bank.

- Public Sector Bank.

- Private Sector Bank.

- Cooperative Bank.

- Regional Rural Bank.

What are New Generation Banks ?

- Banks which started functioning after LPG(Liberalization, Privatization, Globalisation).

- Introduced State of the art technology.

Revolving Credit

- Credit Cards are example of Revolving Credit used by consumers.

- The borrower may use or withdraw funds up to a pre-approved credit limit.

- The amount of available credit decreases and increases as funds are borrowed and then repaid.

Credit Card

Money spend from an allocated credit limit.

Debit Card

Money withdrawn from once on account balance.

NBFC (Non Banking Financial Corporation)

- NBFC's are not included in the second schedule of RBI act 1934.

Challenges phased by PSBs in India ?

- Non Performing Assets

- New Generation Banks.

- Technology Implementation.

- Innovative Products such as the auto sweep facility.

- Better levels of customer care.

Selective Credit Control (SCC)

Suppose a Sugar manufacturer is expecting a price rise after a certain period of time. He pledges the existing stock of sugar in the go-down and takes a loan. He invests this money for further manufacturing. Thus the manufacturer creates an artificial scarcity and sells the sugar at higher prices.

Selective Credit Control is a policy brought out by the govt to avoid such hording of necessary products in the market. Credit facility will not be provided to certain products during certain period of time.

RESERVE BANK OF INDIA

The Head Office of Reserve Bank of India is at Mumbai. It got its membership of Bank of International Settlements(BIS) in September 1996.

GOVERNOR

- Dr. Duvvuri Subbarao.DEPUTY GOVERNORS

- Dr K.C.Chakrabarthy

- Shri Qurjid Patel (replacing Dr Subir Gokaran).

- Shri Anand Sinha.

- Shri H.R.Khan.

Functions of RBI:

- Issuer of Currency.

- Banker to the Government.

- Bankers' Bank.

- Controller of Credit.

- Custodian of Foreign Reserves (Dollar, Euro, Pounds sterling, Yen).

COMMERCIAL BANKS

Commercial banks in India include,

- Public Sector Scheduled Banks.

- Private Sector Scheduled Banks.

- Private Sector Non-Scheduled Banks.

- Scheduled Bank are those which are entered in the Second Schedule of RBI Act, 1934.

- Non Scheduled Bank are those which are not included in the second schedule of RBI Act, 1934.

Scheduled Banks

- Should have a minimum paid up capital as per the RBI Norms.

- Will not take up activities that will adversely affect the depositors.

- Eligible to get loans from RBI.

- Becomes part of the Clearing House.

Public Sector Banks

PSBs are commercial banks whose majority shares are owned by the Governemnt of India.- Allahabad Bank.

- Andhra Bank.

- Bank of Baroda.

- Bank of India.

- Bank of Maharashtra.

- Central Bank of India.

- Canara Bank.

- Corporation Bank.

- Dena Bank.

- Punjab National Bank.

- Punjab and Sindh Bank.

- Vijaya Bank.

- Union Bank of India.

- UCO Bank.

- United Bank of India.

- Indian Bank.

- Indian Oversease Bank.

- Oriental Bank of Commerce.

- Syndicate Bank.

- IDBI Bank.

- SBI and Associate Banks.

New Generation Banks in India

- Axis Bank.

- HDFC Bank.

- ICICI Bank.

- ING Vysya Bank.

- Indusind Bank Ltd.

- Kotak Mahindra Bank.

- YES Bank.

Foreign Banks Operating in India

- ABN-AMRO.

- Bank of America.

- Barclays Bank.

- Standard Chartered Bank.

- Deutsche Bank.

-

City Bank.

Co-operative Banks

These are banks establishe with cooperative ownership.

Regional Rural Bank(Gramin Bank)

- Paid up capital contributed by Central Govt, State Govt and a Public Sector Bank.

- Short term loans issued by NABARD.

- South Malabar Gramin BankHQ- Malappuram.

Sponser Bank- Canara Bank. - North Malabar Gramin Bank.HQ- Kannur.

Sponser Bank- Syndicate Bank.

SBI AND ITS ASSOCIATE BANKS

- Presidency banks were established by the British which include Bank of Bengal, Bankof Bombay and the Bank of Madras.

- In 1921, all the presidency banks were merged and renamed as 'The Imperial Bank of India'.

- On the recommendations of the rural credit survey Committee the Imperial Bank of India was converted into the State Bank of India on July 1, 1955.

- 92 percent of its shares were acquired by the RBI. Thus it became the first state owned commercial bank in the country.

- In 1959, the Steate bank of India(Associate Banks) Act was passed and this paved the way for creating the State Bank Group.

- STATE BANK GROUP included

- State Bank of Hyderabad.

- State Bank of Bikaner and Jaipur.

- State Bank of Indore (Merged with SBI in 2010).

- State Bank of Mysore.

- State Bank of Patiala.

- State Bank of Surashtra (Merged with SBI in 2008).

- State Bank of Travancore.

- Now Union Governments share holding in SBI is 51%.

- The State Bank of India and its associate banks constitute 20 % of the total branches of all the commercial banks.

- The share of banking bussiness of state bank group is roughly 29%.

Objectives of Nationalisation of Banks.

- Social Welfare.

- Reduce Private Monopoly.

- Priority Sector Lending.

- Reduce Regional Imbalance.

- Expansion of Banks.

Nationalisation of Banks STAGE 1.

- 14 major commercial banks nationalised on 19th July, 1969.

- All Commercial Banks with a deposit over 50 crores.

Nationalisation of Banks STAGE 2.

- 6 more commercial banks were nationalised in 1980.

- In 1993, New Bank of India merged with Punjab National Bank.

CBS- Core Banking Solutions.

- Centralised Online Real Time Exchange.

- Provides anywhere any time Banking.

- A series of services provided by a group of Networked Branches.

- Avail Banking services from any branch of the Bank on CBS network, regardless of where he maintains his account.

Core Banking Softwares

- Finacle- INFOSYS.

- TCS BaNCS- TCS.

- Flexcube- Oracle.

- SAP.

FINANCIAL INCLUSION

LEAD BANK SCHEME

- The idea of lead bank scheme was mooted by the Gadgil Study Group in 1969. It had the strong backing of Narasimhan committe also.

- The Government of India Constituted a High power committe headed by Mrs. Usha Thorat, the then deputy governor of the RBI(2009) to suggest reforms in the Lead Bank Scheme.

The recommendations of the Usha Thorat Committee are:

- LBS should be continued to accelerate financial inclusion in the unbanked areas of the country.

- Private Sector Banks should be given a greater role in LBS action plans, particularly in areas of their presence.

- Enhance the Business Correspondent model, making banking services available in all villages having a population of above 2,000.

- Relaxation of KYC(Know Your Customer) norms for small value accounts.

REGIONAL RURAL BANKS

- The Working Group on Rural Banks under the chairmanship of Shri. U. Narasimham recommended the setting up of Reginal Rural Banks as part of multi agency approach to rural credit.

- The Regional Rural Banks meet the credit requirements of weaker sections, small and marginal farmers, landless labourers, artisans and small entrepreneurs.

PRIORITY SECTOR LENDING

- The concept of Priority Sector Lending was introduced by RBI to avoid the public money being diverted and misutilised for private profit.

- RBI directed the domestic banks to provide 40% of their net credit to the priority sector, while it is 32% for foreingn banks.

The concept of Priority Sector Lending covered neglected setors like:

- Agriculture.

- Small Scale Industry(SSI).

- Road Transport.

- Retail Trade.

- Professional and Self Employed Persons.

- Housing and Education Loans.

- Loans given to SC/ST's.

- Artisans.

NON PERFORMING ASSETS

- Non-Performing assets are bad debts of banks/financial institutions.

- An asset becomes non performing when it ceases to generate income for the bank.

- NPA means a asset or borrowal account which has been classified by a bank or financial institution as sub-standard, doubtful or lost asset, in accordance with the guidelines issued by the RBI.

- A Sub-Standard asset is the asset in which bank has to maintain 10% of its reserves.

- All those assets which are considered as non-performing for a period of more than 12 months is called Doubtful Assets.

- All those assets which cannot be recovered is called a Lost Asset.

SARFAESI Act

- Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act 2002, enables banks to realize their dues without intervension of courts and tribunals.

- The act enables the setting up of Asset Management Companies, to acquire NPAs of any bank or financial institution by issuing debentures, bonds or any other security.

This company(which is the second creditor) is entitled to serve a notice to the borrower to discharge his her liabilities whin 60days, failing which the second creditor is entitled to take possession of the secured assets.

DEBENTURES

A Debenture is a certificate of loan or loan bond evidencing the fact that the company/person is liable to pay a specific amount with interest and although the money raised by the debentures become a part of the companies capital structure, it does not become the share capital.

- CONVERTIBLE DEBENTURES.

Convertible Debentures are bonds that can be converted into equity shares of the issuing company after a predefined period of time. Convertible bonds typically have lower interest rates than Non-Convertible bonds.

- NON CONVERTIBLE DEBENTURES.

Non Convertible bonds are bonds that cannote be converted into equity shares of the issuing company. Non-Convertible bonds carry higher rate of interest than convertible bonds.

NARSIMHAM COMMITTEE RECOMMENDATIONS ON FINANCIAL REFORMS, 1991

The Government of India constituted a 9 member committee under the chairmanship of

M. Narasimham, a former Governor of the RBI to examine all aspects relating to the structure, organisation functions and procedures of the financial system in India.

Recommendations of Narasimham committee include:

- Substantial reduction in the no: of public sector banks through mergers and acquisitions. A 4 tier banking system was proposed.

- RBI should permit setting upof new banks in the private sector.

- The Governement should allow foreign banks to open offices in India.

- Setting up of Asset Reconstruction Fund (ARF) to take over from nationalised banks and financial institutions, a portion of their bad and doubtful debts at a discount.

- Appointment of Charman and MD of banks should not be based on political considerations but on professionalism and integrity.

- Governemnt should reduce the SLR from 38.5% to 25% over the next 5 years(Now it is 23%).

- Reduce CLR from 15% to 3 to 5%( Now it is 4.25%).

- Banks should be given more autonomy.

- The system of dirtect credit program should be gradually phased out.

- The RBI should simplify the structure of interest rates.

NARASIMHAM COMMITTE REPORT ON BANKING SECTOR REFORMS, 1998

Recommendations of the committee include:

- Merger of strong banks which would have a multiplier effect on industry.

- Setting up of small local banks which would be confined to states or a cluster of districts in order to serve local trade, small industry and agriculture.

- Higher Capital Adequecy requirements for banks to improve their inherant stength and their risk absorption capacity.

- Urgent need to review and amend the previous RBI Act, Banking Regulation Act, SBI Act, Bank Nationalisatiuon Act etc.

- Need for computerization process in PSBs.

CAPITAL ADEQUECY RATIO(CAR) OR CAPITAL TO RISK(WEIGHTED) ASSETS RATIO(CRAR)

CAR is a measure of the amount of a banks core capital expressed as a percentage of its risk-weighted asset.

Minimum requirements of capital fund in India:

* Existing Banks 09 %

* New Private Sector Banks 10 %

* Banks undertaking Insurance business 10 %

* Local Area Banks 15%

* Existing Banks 09 %

* New Private Sector Banks 10 %

* Banks undertaking Insurance business 10 %

* Local Area Banks 15%

BANK RATE(Now 9%)

Bank Rate is the long term lending rate of RBI to various commercial banks. RBI uses changes in Bank Rate to regulate fluctuations in Exchange Rate and Domestic Inflation. In recent past, Prime Lending Rate(PLR) is decided by commercial banks with referance to bank rates and deposit positions of each bank.

CASH RESERVE RATIO- CRR (Now 4.25%)

Every commercial bank is required to keep a certain percentage of its Net Demand and Time Liabilities(NDTL) with the RBI.

STATUTORY LIQUIDITY RATIO- SLR (Now 23%)

In addition to the CRR, every commercial bank is required to keep a certain percentage of their Net Demand and Time Liabilities(NDTL) as liquid assets in the form of cash, gold or approved securities as reserves with themselves.

REPO RATES (Now 8%)

Repo rate is the rate at which RBI lends money to the commercial banks for short term.

Increasing Repo Rate is another method to control Inflation.

Increasing Repo Rate is another method to control Inflation.

REVERSE REPO RATE( Now 7%)

Reverse Repo is the rate at which commercial banks part their excess money with the RBI.

Repo and Reverse Repo Rates are instruments used by RBI in liquidity management;

- In case of inflationary tendencies, RBI can hike the Reverse Repo Rate and absorb the excess liquidity in the market.

- Similarly when it is required to inject liquidity into the system, RBI can reduce the Repo Rate, which will lead to release of money into the market.

OPEN MARKET OPERATIONS

This refers to the RBI buying and selling of eligible govt securities to regulate money supply. After the large inflow of foreign funds since 1991, RBI has had to step in to stabilise the flow to avoid excess liquidity.

PRIME LENDING RATE (Decided by the bank)

S.S TARAPORE COMMITTEE, 1997

A 5 member committee was set up by the RBI under the chairmanship of former RBI Deputy Governor S.S.Tarapore to lay the roadmap to Capital Accounts Convertability.

Capital Account Convertability is the ability to conduct transactions of local financial assets into foreign financial assets freely and at country determined exchange rates.

Current Account Convertibility means “the freedom to convert one currency into other internationally accepted currencies......wherein the exporters and importers where allowed a free conversion of rupee. But still none was allowed to purchase any assets abroad.

Whereas Capital Account Convertibilty means that rupee can now be freely convertible into any foreign currencies for acquisition of assets like shares, properties and assets abroad.

Functions of a Bank

Primary Functions

Accepting Deposits.

Savings Deposits.

Current Deposits.

Fixed Deposits.

Recurring Deposits.Granting Advances.

Overdraft

Cash Credit.

Loans.

Discounting of Bills.

Secondary Functions

Bancassurance.

Mutual Funds.

Demat Account.

Public Provident Fund.

Letter of Credit.

Bank Guarantee.

Project Financing.

Selling of Gold Coins.

Mergers and Acquisitions.

BANCASSURANCE

The Bank Insurance Model(BIM), also known as Bancassurance, is a partnership or relationship between a bank and an inssurance company whereby the insurance company uses the bank sales channel in order to sell insurance products.

Both the bank and the insurance company share the commission.

MUTUAL FUNDS

- Mutual Fund is a type of professionally managed Collective Investment Vehicle. Mutual Fund Companies have Fund Managers who invest the funds secured from a pool of customers, in different sectors.

- When Mutual fund is floated normally 1 unit= say 10Rs(Net Asset Value)

100 units= 1000RS

- If the mutual funds makes more profit the NAV increases.

- When NAV is down customers purchases more units and sell in when market recovers and NAV goes up.

- Mutual Fund is a Tax Saving Instrument.

Selection of Mutual Fund schemes depends on-

- When did you want returns (1yr, 3yrs, 5yrs etc).

- How much of risk you can take.

NO RISK

Invest in Government Securities which gives you Guaranteed Returns.

WILLING TO TAKE RISK

Invest in Shares, Real Estate.

WANT LIQUIDITY

Purchase Gold.

DEMAT ACCOUNT (Dematerialised Account)

Demat Account refers to Dematerialised Account for individual Indian citizens to trade in listed stocks or debentures in electronic form rather than paper, as required for investors by the SEBI.

Demat account can be oppened in a Bank.

To buy and sell shares we need to also open Trading Account.

In the past we used to get a share certificate when we buy shares. This has certain limitations-

- Loss of Documents.

- Limit in the number of shares sold physically.

PUBLIC PROVIDENT FUND (PPF)

Public Provident Fund is a savings-cum-tax-saving instrument in India. It also serves as a retirement planning tool for many of those who do naot have any structured pension plan covering them.

The account can be opened in designated post offices and nationalised banks. ICICI Bank was the first private sector bank which was authorized to open PPF accounts.

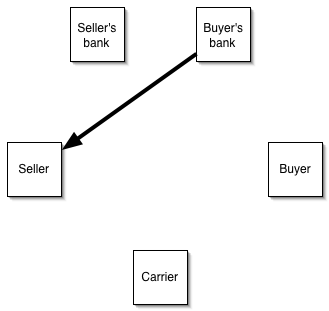

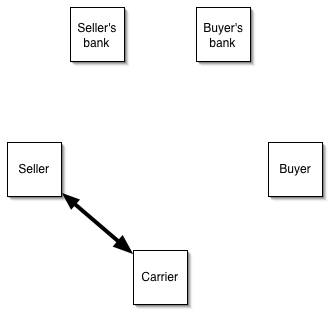

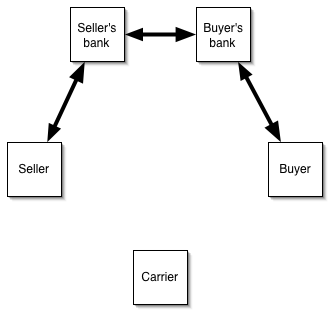

LETTER OF CREDIT

BANK GUARANTEE

PROJECT FINANCING

MERGERS AND ACQUISITION

MERGER

ACQUISITION

BANKING TERMINOLOGY

ACCOUNT

Running record of transactions which are taking place between two transactors.

ASSET

When a Balance Sheet of a bussiness is drawn up, everthing which it owns at the time which has a money value is listed as an asset.

They May be classified as:

- Current Assets.Consisting of Cash, Stock and Book Debts.

- Fixed Assets.

Consisting of Building , Plant and Machinery. - Intangible Assets.

Goodwill, Patents etc.

BALANCE SHEET

A financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time.

EQUITY

In finance, in general, equity is ownership in any asset after all debts associated with that asset are paid off. Stocks are equity because they represent ownership in a company.

BRIDGE LOAN

A loan made by a bank for a short period to make up for a temporary shortage of cash.

CALL LOAN

A loan which may be terminated or called at any time by the lender or borrower.

CAPITAL ASSET

An asset which is not bought or sold as part of the everyday running of the bussiness. Example Real Estate, Plant Equipments etc.

CASH

Money in the form of Bank Notes and Coins.

CASH COW

Units in large bussiness enterprises which yield high earnings but often have low growth potential.

CERTIFICATE OF DEPOSIT(CD)

A document which is issued by a bank acknowledging a deposit of money with it and constituting a pronise to repay that sum, to the bearer, at a specified future date. it is a Negotiable Instrument, ie. can be transferred.

DEAR MONEY

Money available at very high interest rate.

CHEAP MONEY

Money available at very low interest rate.

CALL MONEY

Money which has to be Repayed on Demand.

FINANCIAL LITERACY

Understanding of various financial products.

FULL FORM

- BIS- BANK OF INTERNATIONAL SETTLEMENT.

- CAR- CAPITAL ADEQUACY RATIO.

- BCBS- BASEL COMMITTEE FOR BANKING SUPERVISION.

- FATF- FINANCIAL ACTION TASK FORCE.

- ALM- ASSET LIABILITY MANAGEMENT.

- GAAP- GENERALLY ACCEPTED ACCOUNTING PRINCIPLES.

- IFRS- INTERNATIONAL FINANCIAL REPORTING STANDARDS.

- GATT- GENERAL AGREEMENT OF TARIFF AND TRADE.

- UNDP- UNITED NATIONS DEVELOPMENT PROGRAM.

3 SECTORS OF THE ECONOMY

- PRIMARY- Agriculture, Forestry, Fishery, Animal Husbandry.

- SECONDARY- Mineral, Power, Mining, Manufacturing, Industries.

- SERVICES- Transport, Trade, Communication, Banking, Insurance, Real Estate.

GDP- GROSS DOMESTIC PRODUCT

Value of all goods and services produced in a country during a given year.

India's GDP = $ 1.82 trillion.

Agriculture = 14%

Manufacturing = 27%

Services = 59%

GNP- GROSS NATIONAL PRODUCT

Value of all goods and services produced by Indian Nationals whether they are staying in India or abroad.

GNP= GDP- Value of all goods and services produced by foreign nationals in India+ Value of Goods and Services produced by Indians abroad( May be NRIs or People of Indian Origin)

FISCAL DEFICIT

Fiscal Deficit is the difference between the total Receipts and total Expenditure.

Receipts- Direct Taxes(Income Tax, Excise Duty, Service Tax), Indirect taxes(Value Added Tax), Non Tax Revenue.

Expenditure- Interest Payment, Central Plans, Defense, Subsidy etc.

INFLATION

Too much money chasing too few goods.

Controlling Inflation

- Monetary Policy (Related to RBI controlling various Policy Rates and Reserve Ratios).

- Fiscal Policy (Related to taxation).

- Inflation is calculated based on WPI(Wholesale Price Index) and CPI(Consumer Price Index).

- WPI includes Primary Articles, Manufacturing Goods, Fuel and Power.

- CPI includes Food items.

RBI is closely monitoring the inflation. Review of economy is done once in every 45 days compared to 3 months earlier.

REAL AND NOMINAL INTEREST RATES

Real Interest Rate(2%)= Nominal Interest Rate(9%)- Rate of Inflation(7%).

Difference Between FDI & FII

- FDI or Foreign Direct Investment is an investment that a parent company makes in a foreign country. On the contrary, FII is a investment made by an investor in the markets of a foreign country.

- FII can enter the stock market easily and also withdraw from it easily. But FDI cannot enter and exit that easily.

- FDI targets a specific enterprise. FII helps in increasing capital availability in general.

- FDI is considered to be more stable than FII.

- FDI not only brings in capital but also helps in good governance practices and better management skills and even technology transfer. FII just helps in increasing Capital inflow.

CURRENT ACCOUNT CONVERTIBILITY

The freedom to covert one currency into other internationally accepted currencies for purposes other than purchasing assets abroad.

For example for;

- Export.

- Import.

- Travel.

- Study Abroad.

- Medical Treatment.

- Employment Abroad.

CAPITAL ACCOUNT CONVERTIBILITY

The freedom to convert local financial assets into foreign financial assets and vice-versa at market determined rates of exchange.

1997- Tarapore Committee on Capital Account Convertibility

COMPANY

- Proprietorship Firm.

- Partnership Firm.

- Private Limited Company.

- Public Limited Company.

- Limited Liability Company.

PROPRIETORSHIP FIRM

- Single Ownership.

- Autonomy in Decision Making.

- Unlimited Liability.

- Can be winded up without any prior legal notice.

PARTNERSHIP FIRM

- Partnership Deed registered in Registrar of Companies.

- Has Unlimited Liability.

COMPANY

- Separate Legal Entity.

- Limited Liability.

- Perpetual Succession (Ratan Tata -----> Cyrus Mistry)

- Transferability of shares.

- Owner and Management may not be the same.

- One share- One vote.

PRIVATE LIMITED COMPANY

- To Register as a Private Limited Company- minimum 2 persons, Maximum 50 persons.

- Must Register in Registrar of Companies

- Memorandum of Association(MOA)- MOA is a document that governs the relationship between the company and the outside.

- Article of Association(AOA)- Defining the responsibility of the directors, The kind of Business to be undertaken and the means by which the share holders exert control over the Board of Directors.

PUBLIC LIMITED COMPANY

- Must be listed in Stock Markets.

- No of investors , Minimum- 7 persons, Maximum- No Limit.

LIMITED LIABILITY COMPANY

- Brought in India, under Limited Liability Act 2008.

- Subject to approval from Registrar of Companies.

- Inflation is calculated based on WPI(Wholesale Price Index) and CPI(Consumer Price Index).

- WPI includes Primary Articles, Manufacturing Goods, Fuel and Power.

- CPI includes Food items.

RBI is closely monitoring the inflation. Review of economy is done once in every 45 days compared to 3 months earlier.

REAL AND NOMINAL INTEREST RATES

Real Interest Rate(2%)= Nominal Interest Rate(9%)- Rate of Inflation(7%).

Difference Between FDI & FII

- FDI or Foreign Direct Investment is an investment that a parent company makes in a foreign country. On the contrary, FII is a investment made by an investor in the markets of a foreign country.

- FII can enter the stock market easily and also withdraw from it easily. But FDI cannot enter and exit that easily.

- FDI targets a specific enterprise. FII helps in increasing capital availability in general.

- FDI is considered to be more stable than FII.

- FDI not only brings in capital but also helps in good governance practices and better management skills and even technology transfer. FII just helps in increasing Capital inflow.

CURRENT ACCOUNT CONVERTIBILITY

The freedom to covert one currency into other internationally accepted currencies for purposes other than purchasing assets abroad.

For example for;

For example for;

- Export.

- Import.

- Travel.

- Study Abroad.

- Medical Treatment.

- Employment Abroad.

CAPITAL ACCOUNT CONVERTIBILITY

The freedom to convert local financial assets into foreign financial assets and vice-versa at market determined rates of exchange.

1997- Tarapore Committee on Capital Account Convertibility

COMPANY

- Proprietorship Firm.

- Partnership Firm.

- Private Limited Company.

- Public Limited Company.

- Limited Liability Company.

PROPRIETORSHIP FIRM

- Single Ownership.

- Autonomy in Decision Making.

- Unlimited Liability.

- Can be winded up without any prior legal notice.

PARTNERSHIP FIRM

- Partnership Deed registered in Registrar of Companies.

- Has Unlimited Liability.

COMPANY

- Separate Legal Entity.

- Limited Liability.

- Perpetual Succession (Ratan Tata -----> Cyrus Mistry)

- Transferability of shares.

- Owner and Management may not be the same.

- One share- One vote.

PRIVATE LIMITED COMPANY

- To Register as a Private Limited Company- minimum 2 persons, Maximum 50 persons.

- Must Register in Registrar of Companies

- Memorandum of Association(MOA)- MOA is a document that governs the relationship between the company and the outside.

- Article of Association(AOA)- Defining the responsibility of the directors, The kind of Business to be undertaken and the means by which the share holders exert control over the Board of Directors.

PUBLIC LIMITED COMPANY

- Must be listed in Stock Markets.

- No of investors , Minimum- 7 persons, Maximum- No Limit.

LIMITED LIABILITY COMPANY

- Brought in India, under Limited Liability Act 2008.

- Subject to approval from Registrar of Companies.

No comments:

Post a Comment